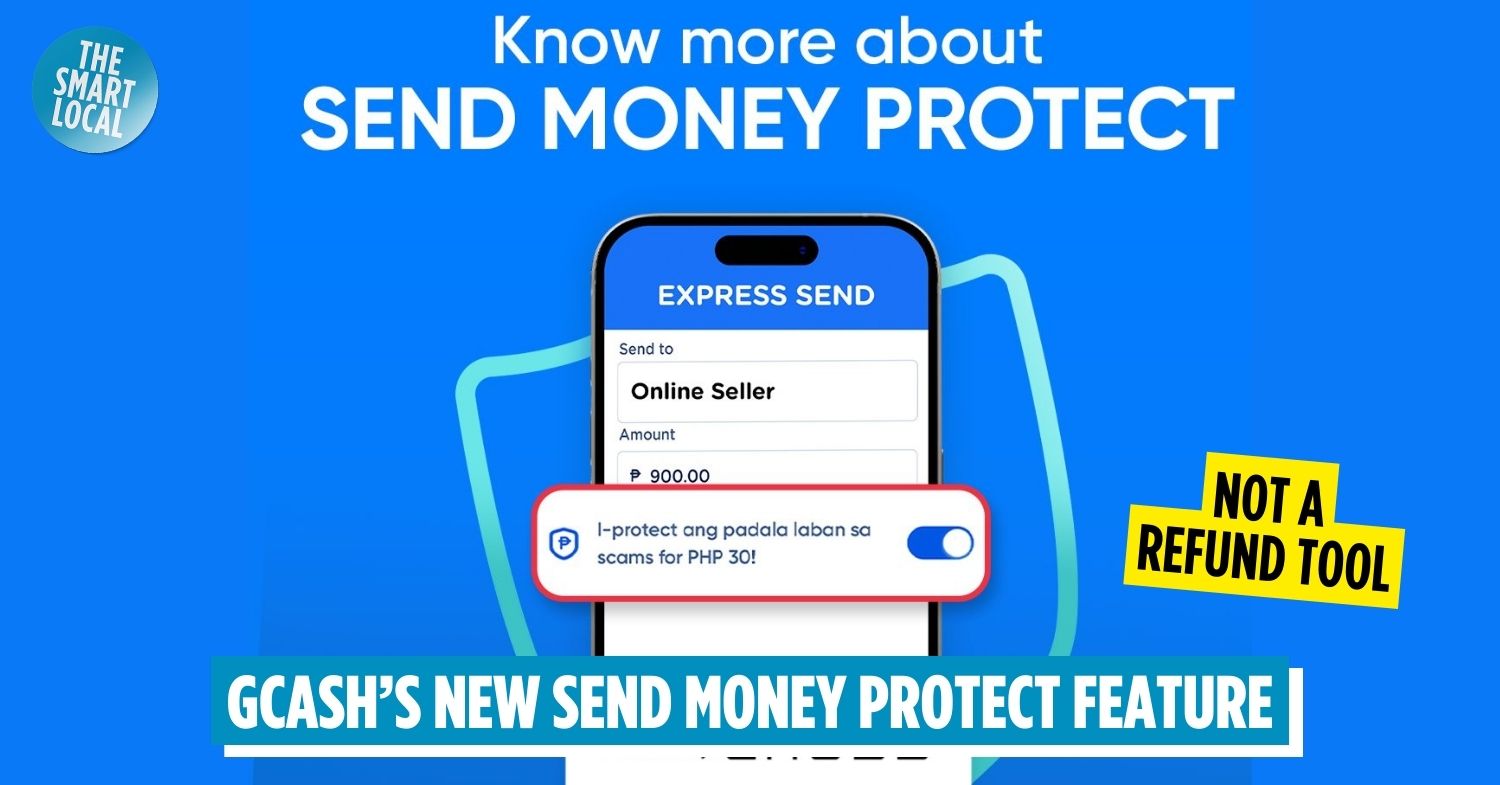

GCash’s new Send Money Protect add-on

Given its extensive range of features, it’s no surprise that GCash is arguably the most popular e-wallet in the Philippines. However, this also exposes the app to the risk of being used for scams.

In response, the app has introduced the optional Send Money Protect add-on, available within its Express Send feature. For a fee of P30, this provides protection against online scams, whether you’re online shopping or simply transferring money to another individual.

What buyers should know

Image credit: @gcashofficial via X

Image credit: @gcashofficial via X

You don’t have to pay the P30 fee per transaction. One payment of P30 already covers all your Express Send transactions for one month, providing insurance for amounts up to P15,000.

If a seller refuses to use the feature, exercise caution, as they may have malicious intentions. However, it’s also possible that they are simply not aware of the feature.

Keep in mind that having the feature is not a refund tool nor does it guarantee a successful insurance claim. Like all kinds of insurance, it’s still subject to policy conditions.

Also take note that the Send Money Protect feature does not apply to incorrect transactions. So, make sure to double-check the phone number and amount before hitting send.

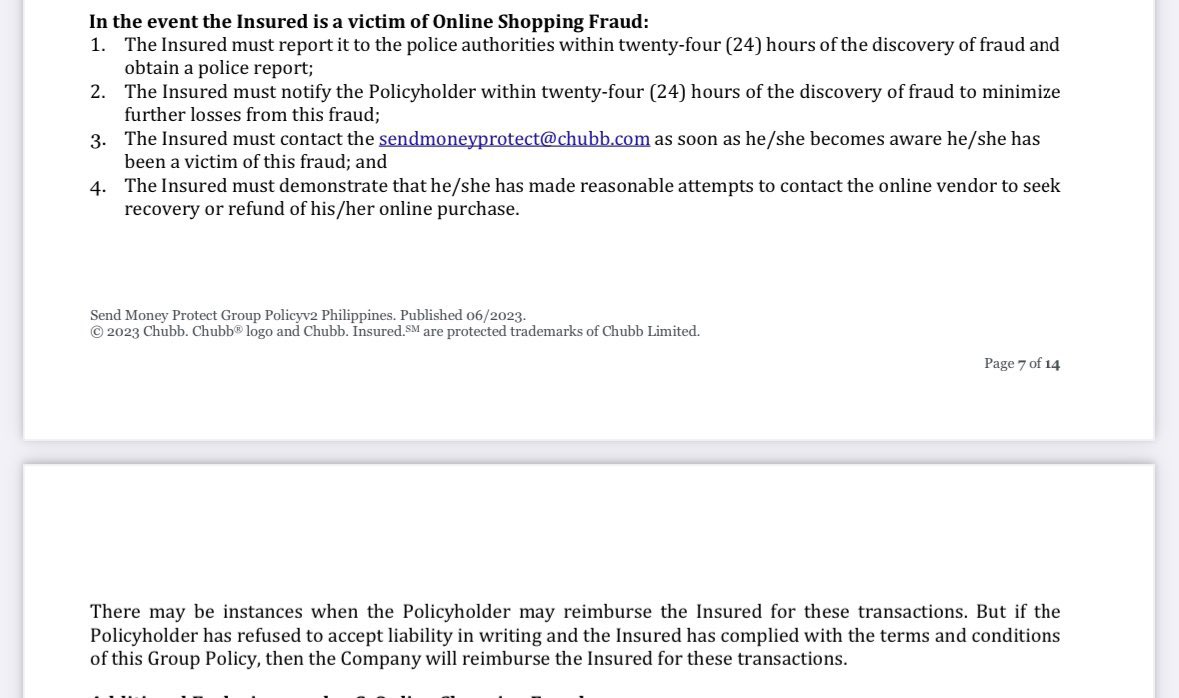

How to file a report and claim the insurance

Image credit: @jaeimins_co via X

Image credit: @jaeimins_co via X

If you discover that you’ve fallen victim to a scam, it’s crucial to file a police report promptly—preferably within 24 hours to avoid additional losses.

Image credit: @jaeimins_co via X

Image credit: @jaeimins_co via X

Next, notify the insurance provider by sending an email to [email protected]. Include important details such as your group policy number, confirmation of cover number, proof of purchase (e.g., receipt), and the crime reference number from your police report.

When submitting these two reports, having screenshots of your communication attempts with the seller is useful to support your claim of being scammed.

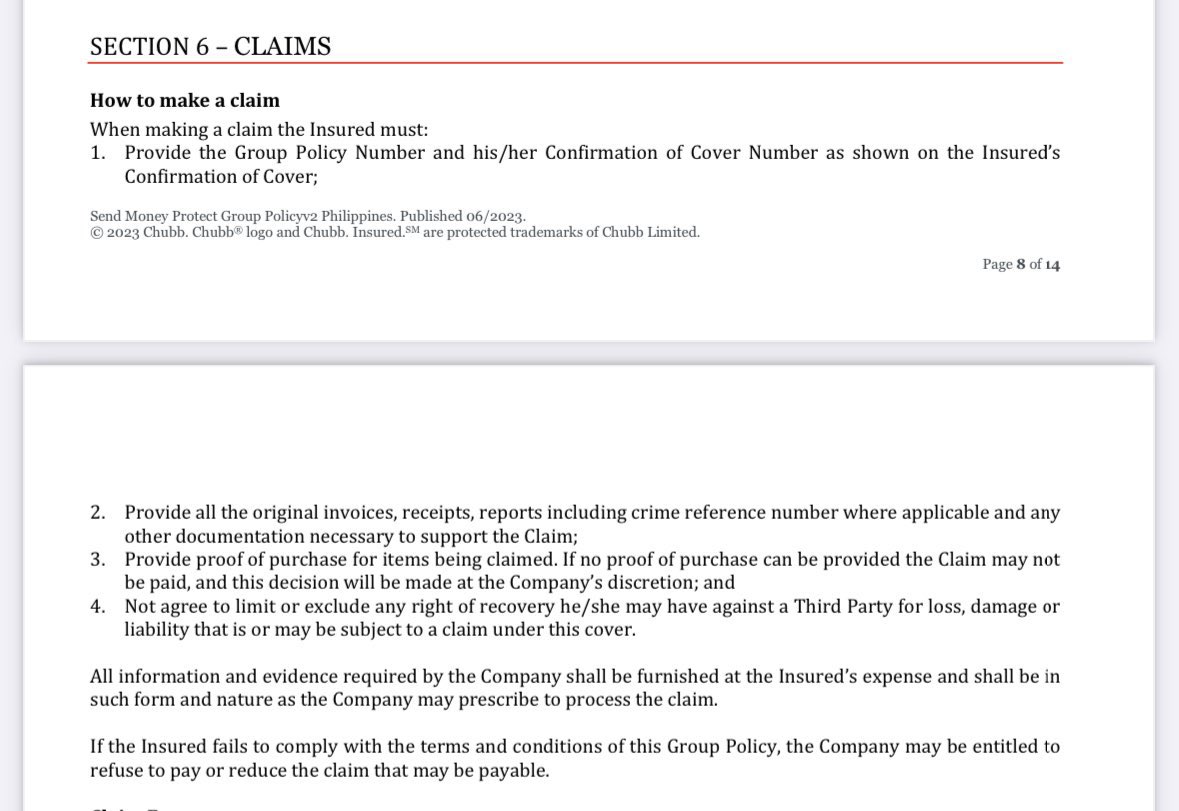

What sellers should know

Image credit: @gcashofficial via X

Image credit: @gcashofficial via X

Online sellers don’t have to worry about the Send Money Protect feature too. As stated above, it’s not a refund tool but an insurance. Buyers cannot take their payments back, so you can still do your business with confidence.

Essentially, there’s nothing to worry about if you don’t have the intention of scamming people for money online.

Things to know about the Send Money Protect feature

Thanks to the new Send Money Protect, we can now do quick, online payment transactions without having to worry about getting scammed. Features like this come in handy, especially in an age where much of our activities are done online.

Maximize your Gcash account by familiarizing yourself with the multitude of handy GCash features. Additionally, be aware of the various KKB scams to protect your hard-earned money stored on the popular e-wallet.

Cover image adapted from: @gcashofficial via X