Scams in the Philippines to look out for

For many Filipinos, the pandemic pushed us to work, study, and buy things through the internet, spending most of our time in front of screens— which unfortunately resulted in more scams in the Philippines, especially online.

In fact, Fintech Alliance PH, who are experts in the online finance industry, said in 2021 that now, more than ever, Filipinos should be wary of online swindlers. So, we’re listing eight of these common scams you can spot and definitely stay away from.

1. Compromised bank account calls

All of our banking information is protected under the Data Privacy Act of 2012, so it’s unnerving to find so many stories about people getting fake calls from supposed bank representatives claiming that you need to update your bank details. Here’s how you can spot that scam call and avoid getting your life savings stolen.

A scam call usually starts like this— you receive the call from a regular mobile phone number, not a landline phone number or a specialized number such as 1-800. You’ll also notice that the fake bank representative on the other line, will know most of your banking information, such as your full name, birthday, and address.

But here is when it gets sketchy, the scammer will tell you different versions of why you need to supposedly verify your account with them. Some will say it’s because your account is already compromised; others will tell you it’s for issuing you a new debit or credit card.

These fraudsters will say that they need you to verify your bank card numbers, this is a trick, of course, because they need your entire 16-digit debit or credit number. And then, they will insist on getting your credit card CVV or your one-time password (OTP). The OTP is the number you receive through your registered phone number every time you log in to your account.

Some scammers say that they are the ones sending you this OTP, calling it a ‘verification code’, but in reality, they are already logging into your account, and they just need the OTP to gain full access.

Make sure you never share your CVV or OTP with anyone over the phone, and when in doubt, you can always call the bank directly instead.

– A scam call in the Philippines recorded on video –

In a video from Orville Mancilla’s TraVille channel on Youtube, a fake bank representative tried to fool him by saying that he is receiving a bank stipend of P8,000 (~USD155.17) because of the pandemic.

The scammer tries to trick him into giving his OTP, saying it’s a reference number for him to claim the money and also asks for his credit card details, but fails because Mancilla already knew it was a scam and said he didn’t have the card with him. In the end, the scammer cuts the line short.

Video credit: TraVille

2. Cash-on-delivery (COD) shopping scams

A fake delivery item

Image credit: Anne May Teves

Filipinos have fallen in love with the idea of online shopping; that’s why there are even Facebook groups solely dedicated to communities sharing their home improvement purchases or newfound hobbies. This is most likely the reason why the cash-on-delivery (COD) scam now exists.

These delivery scammers already have your name, contact, and address right, and will tell you that they have your order; you’ll just need to pay the item and delivery fee, which is not unusual, especially if you often choose to pay cash upon delivery. But the catch is, when you open the item, there’s nothing in the package but rocks, paper, or even tattered rags.

The best way you can avoid this scam is to pre-pay for all your online shopping orders, and make sure you tell your household not to unquestioningly pay for and accept deliveries.

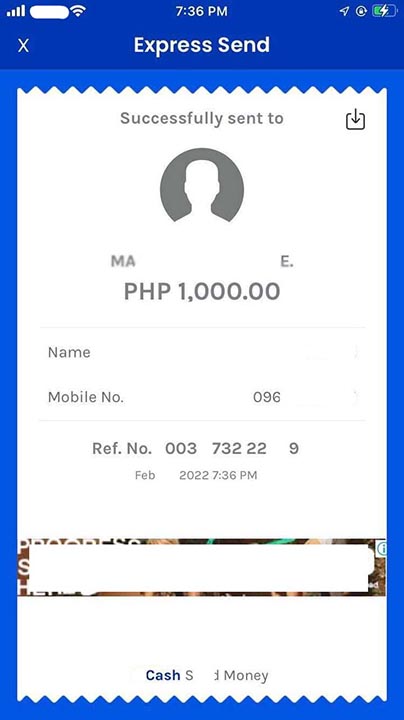

3. Fake online payment proof shots

An example of an online money transfer receipt

Aside from being consumers, a lot of Filipinos now trade and sell online; this is why scammers saw this as another opportunity to trick people with fake online payment proof shots.

So, let’s say you’re selling an item online. The scammer will pose as a buyer and go through the normal back and forth conversation of a buyer and seller with you, but when it’s time for them to send you the online payment to your e-wallet, they will send you a fake screenshot of the transaction instead.

Usually, when someone sends you money online, the payment channel informs you that it’s landed in your account through a text message. The amount can also instantly reflect in your account balance.

But when this doesn’t happen and you start verifying, scammers will make excuses, saying it’s a system issue or a glitch. They will pressure you to finish the transaction or end up losing them as a buyer.

You can avoid this by making a real-time trade, and be firm that you’ll only give the buyer the item when you receive the payment. You could also check with your bank if there are any pending transactions on your account.

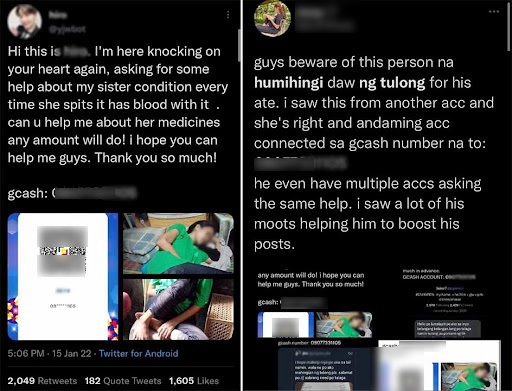

4. Online beggar scams

A Twitter user warns other users regarding a known online beggar who posts the same story on multiple accounts to ask for money

Image credit: @arch3yyy

Before the pandemic, there was a famous modus operandi where a person would suddenly speak up inside the bus or jeepney you were riding to ask for money to use for medical or burial assistance. Those con artists even showed fake documents and pictures, appealing to commuters with made-up sob stories. The same con has now become the online beggar scam.

You’ve probably noticed some of these in the comments section of any viral post or famous person: someone posts a long sob story about someone getting sick, then they’ll ask for money for medical expenses, along with an e-wallet number where you can send money.

This may not be as aggressive as other scams in the Philippines, but is still designed to fool people during the pandemic – a tough time for most Filipinos. There are real people who lost their jobs and are suffering because of the pandemic, and this online begging scam exploits those who just want to help.

So, instead of randomly helping sketchy people online, send donations directly to verified organizations instead to make sure your hard-earned money reaches those in need.

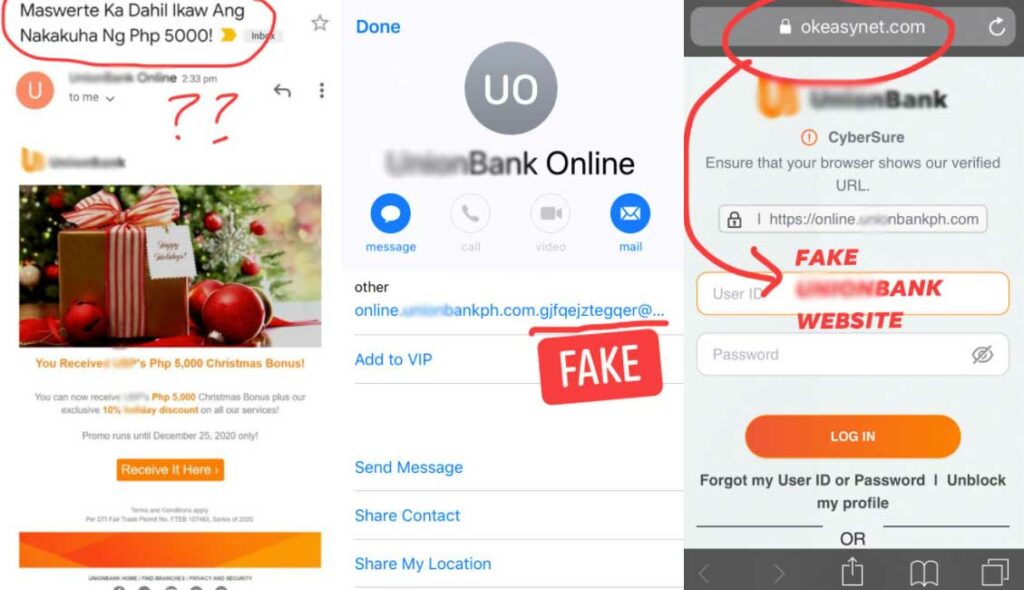

5. Fake bank log-in pages

Example of a phishing email and fake bank website

Image credit: Ella Enriquez

Phishing is one of the oldest digital scams – it’s when scammers try to get your banking information through fake websites. But recently, fake bank log-in pages are proliferating on social media ads.

Back in the day, you’d only receive suspicious log in requests through email, and since most Filipinos don’t regularly use email, that wasn’t a big issue.

But now, this scam uses social media advertising to fool people into clicking their bogus websites. Scammers pose as legitimate banks that say you’ll need to log in on their website to access freebies and enter raffles.

Although alarming, this scam should be easy to steer clear of by not clicking on random posts or links you see on social media and pop-ups. If you’re into raffles and promotions, type in your bank’s website directly into your browser.

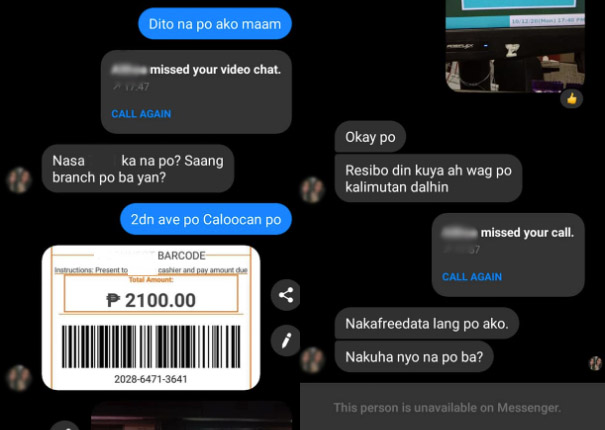

6. Online order scams

The delivery rider was asked to pay for a barcode transfer, then he was blocked on messenger after the transaction without anyone paying him back

Image credit: Gra Cio Sa

Delivery riders have also become targets of online order scams in the Philippines recently. A scammer would book a delivery rider through an app, then ask the rider to pay for an item at the pick-up point, but when they head to the drop-off point, it’s going to be a fake address with no one to pay them back.

Rider groups have supported removing the cash-on-delivery option on food delivery and courier service apps to curb fake orders and scams. In the meantime, it is best not to accept these types of deliveries if you’re a delivery rider.

7. Cooperative (CO-OP) investment scams

(Photo for illustrative purposes only)

Image credit: iiijaoyingiii

Cooperative (CO-OP) scams in the Philippines have existed even before the digital era. The CO-OP, which is a group of people voluntarily pooling their money together to reach a goal or enterprise, seems really promising in the beginning.

The scammers will create a CO-OP that functions like a bank; they usually target a specific group or community such as farmers and overseas Filipino workers (OFWs) and take monthly or weekly contributions from them. The pooled money from these people is then reinvested in another venture or lent to the members with interest.

Co-op scammers promise dividends on top of the money you seem to be saving— that is, until the members realize there’s no money left because the scammers are using it for themselves.

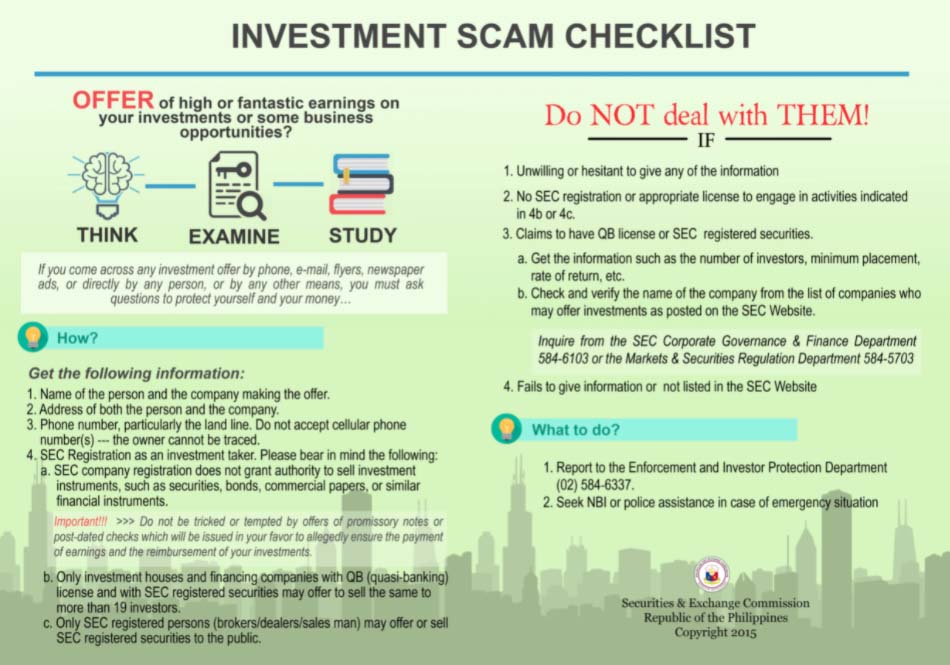

Investment scam checklist, explaining how to verify if an investment offer is fake or legitimate

Image credit: SEC

Avoid investment scams like this by checking the Securities and Exchange Commission (SEC) website to see if the company is registered and is not connected to past or ongoing fraud cases. Always ask questions, as CO-OP scammers like keeping their members in the dark up until they run away with all the money, so don’t be afraid to inquire about the status of your investment.

8. Pyramid schemes

(Photo for illustrative purposes only)

Image credit: Joel Nungay

The DTI warns the public from joining several multi-level marketing (MLM) companies that are now very active in recruiting on social media. Some people call their operation model pyramiding, MLM, or networking; the bottom line is that they all work the same way. These companies earn more money from recruiting members as compared to selling their products.

Joining pyramiding scams in the Philippines can be incredibly enticing to people because, in theory, the more members you recruit, the more you’ll earn. But this business model is not sustainable because when new members can’t recruit additional people, they won’t reach the promised high returns.

And since the products’ sales are not enough to pay everyone, the pyramid will collapse, and people will lose their investments.

Stay away from this kind of scam in the Philippines by looking out for the following red flags:

- The organization asks you to sell products at a premium price, such as unusually expensive soap and vitamins.

- Your recruiter, or “upline”, strongly requires you to recruit more people to get an incentive.

- Organization members tell you that you’ll get rich like them while flaunting their sports cars.

- Members trick people into attending recruitment seminars.

Remember that when it comes to finances, if it sounds too good to be true, it probably isn’t. So, always check the SEC website to know if the business is duly registered and don’t have pending fraud cases.

Say no to these scams in the Philippines

There’s a saying, “prevention is better than cure,” and in the case of scams, it is the same; it is better to be mindful and always be on the lookout to not fall for these tricks.

Also check out these stories on finances:

- Real investment strategies for Filipinos

- E-wallets & other bill payment apps

- Unusual money thief found in Bacolod

Cover image adapted from: Mary Dumale, TraVille, Anne May Teves