HMO & prepaid health cards

If you’ve ever self-medicated or chosen to ignore your symptoms rather than take yourself to a clinic to save for a rainy day, you’ll understand how important having medical coverage in the Philippines is – especially if you’re self-employed or a freelancer.

To help you take care of your health, we’ve compiled some affordable HMO and prepaid health cards below that provide expansive emergency, preventive, and in- and out-patient care so you can find your ideal product.

Table of Contents

- HMO & prepaid health cards

- 1. Insular Health Plan A – Individual – medical care from any of the 6 major hospitals in the Philippines

- 2. MyMaxicare Silver – reimburses emergency care acquired overseas

- 3. Maxicare EReady Advance Platinum – ER care at any of the 6 major hospitals in the country

- 4. Medicard RxER – unlimited medical consultations and emergency care

- 5. InLife ER Care All-In 100 Adults – affordable prepaid health card with a high benefit limit

- 6. InLife She’s Well Violet – prepaid health voucher for women

- Why you should get an HMO or a prepaid health card

1. Insular Health Plan A – Individual – medical care from any of the 6 major hospitals in the Philippines

Makati Medical Center.

Image credit: Hyundai Pasong Tamo

For those living in the metro who want to get top-quality care, Insular Health Plan A offers a P100,000 benefit limit and semi-private room accommodation at any of their accredited hospitals.

These include the 6 major hospitals in the Philippines, namely the Asian Hospital Medical Center, St Luke’s Medical Center Quezon City, St Luke’s Medical Center BGC, Makati Medical Center, Cardinal Santos Medical Center, and The Medical City.

Besides hospitalization, this HMO also covers annual physical exams, outpatient care, and emergency care at Insular Health Care Clinic and accredited hospitals.

However, note that pre-existing conditions are not covered in the first year whether the member is aware of it or not. Coverage in the succeeding year will be subject to evaluation upon renewal.

This HMO starts at P14,320/year (~USD256.96) for a single, 25-year-old. You can also get dental coverage for an additional fee.

Get the Insular Health Plan A – Individual here.

2. MyMaxicare Silver – reimburses emergency care acquired overseas

Image credit: Anna Shvets/Pexels

Image credit: Anna Shvets/Pexels

MyMaxicare Silver is ideal for those who love to travel locally and internationally as this HMO allows the full reimbursement of hospital fees acquired in areas in the Philippines without Maxicare-accredited hospitals. The provider also reimburses up to P30,000 for emergency care abroad.

At P15,110/year (~USD271.90) for a 25-year-old and coverage of P60,000, it covers in-patient care, including the use of the operating room, ICU, and boarding in a semi-private room, as well as in-patient medicine, IVs, and blood transfusion.

There’s also outpatient care that includes consultations, minor injury treatments, minor surgeries, and more. On top of these, you get comprehensive coverage in case of emergencies.

Get the My Maxicare Silver here.

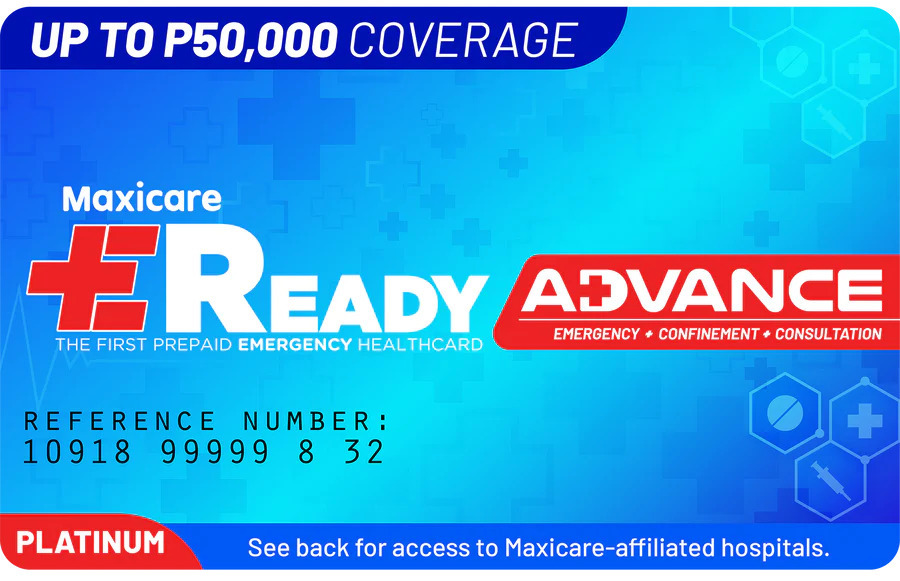

3. Maxicare EReady Advance Platinum – ER care at any of the 6 major hospitals in the country

Image adapted from: Maxicare

If you want an affordable prepaid health card that will help you receive care from a network of hospitals, including the 6 major hospitals in the country, get Maxicare’s EReady Advance Platinum.

It provides care for any medical emergency that requires immediate care and covers doctor’s fees, ER fees, dressing, sutures, and casts for outpatient emergency cases. For in-patient cases, it includes regular private room accommodation and use of the operating room and ICU.

For both in- and out-patient emergency cases, it also bears the cost of medicine, oxygen, intravenous fluids, blood, and laboratory and diagnostic exams.

The Maxicare EReady Advance Platinum costs P3,950 (~USD71.08) and has a P50,000 benefit limit and 1-year validity.

Get the Maxicare EReady Advance Platinum here.

4. Medicard RxER – unlimited medical consultations and emergency care

Image adapted from: Shopee

Medicard RxER (P1,998, ~USD35.95 valid for 1 year) ensures that you’re in tiptop shape with unlimited medical consultations with primary care physicians, general surgeons, OB-GYN doctors, and more at Uro Industrial Clinic and Medicard clinics. Its coverage even includes free dental consultations and one-time dental cleaning.

It also gives you P20,000 coverage for emergencies, particularly trauma cases, animal bites, burns, and chemical poisoning, provided you get care within 6 hours of incidence.

For this, it covers ER fees, professional fees, and medications. Diagnostic procedures and lab tests are also covered up to P5,000 subject to the limit.

Get the Medicard RxER here.

5. InLife ER Care All-In 100 Adults – affordable prepaid health card with a high benefit limit

Image credit: InLife

InLife’s ER Care All-In 100 Adults provides a high benefit limit of P100,000 for only P1,750 (~USD31.49).

This prepaid health voucher takes care of you in case of accidents, viral illnesses such as COVID-19, and bacterial illnesses such as UTIs. In particular, it covers diagnostic procedures, ER care, doctor’s fees, surgery and surgeon’s fees, use of the ICU, and private room accommodations at accredited hospitals.

However, this voucher does not cover pre-existing conditions so it’s more suitable for healthy individuals. It’s also valid for 1 year and can be used only once.

Get the InLife ER Care All-In 100 Adults here.

6. InLife She’s Well Violet – prepaid health voucher for women

Image credit: InLife

For women 19-35 years old who want to get themselves checked annually, InLife’s She’s Well Violet (P12,000, ~USD215.94) is a convenient prepaid health voucher.

It covers diagnostic exams, including transvaginal ultrasound, pap smear, breast ultrasound, as well as consultations before and after these procedures. You also get unlimited teleconsultations with doctors from a wide array of specializations.

Plus, it even has a one-time P20,000 accident coverage that includes in- and out-patient care at an Insular-accredited hospital. This can help you pay for doctor’s fees, laboratory and diagnostic procedures, medicine, and ward accommodation.

Get the InLife She’s Well Violet here.

Why you should get an HMO or a prepaid health card

We work hard to earn a living so we should also take care of ourselves by making sure our medical needs are met in case of emergencies. Substantial medical coverage also helps you keep your savings untouched.

While HMO and prepaid health cards don’t cover you as much as health insurance, they’re still a good means to get coverage for a small price.

Also check out:

Cover image adapted from: cottonbro/Pexels and Anna Shvets/Pexels