Debit cards in the Philippines

If you often have a little extra left from your paycheck and don’t know where to put it, make saving money one of your resolutions in 2023. This can help you get through rainy days.

To help secure your money, here are 7 debit cards in the Philippines for convenient money transfers and savings, including digital banks that offer physical cards.

1. GCash Mastercard – widely used e-wallet in the Philippines

GCash Mastercard.

Image credit: gcash.com

GCash may be more popular as an e-wallet, but it also offers a Mastercard debit card so you can withdraw your GCash money from ATM machines nationwide.

Since it’s widely used in the Philippines, it allows you to quickly transfer money to other GCash accounts. You’ll find many merchants that accept payments through GCash. The app is also rich in features, including convenient bills payment.

Several GCash Mastercard users have also shared on social media that they were able to use their cards abroad with one of the lowest conversion fees among cards in the Philippines.

It’s even easy to apply for a GCash account and ask for a debit card on your phone. You only need a Philippine mobile number and a valid ID. No maintaining balance is required.

Contact: website

2. Maya – 4.5% base interest rate per annum

Choose between Visa and Mastercard.

Image credit: maya.ph

Though Maya (formerly PayMaya) is a digital bank, you can opt to get a Mastercard or Visa card from them. This allows you to enjoy their base interest rate of 4.5% per annum while being able to withdraw from ATM machines and use your card to pay for shopping.

On top of their high interest rate, Maya offers rewards such as vouchers and cashback rebates for payments made using your account. The app also has a savings feature that lets you track up to 5 of your financial goals.

Opening an account is easy. Simply download the Maya app on your mobile and sign up.

Contact: website

3. UnionBank Lazada Debit Card – discount vouchers and cashback rebates

UnionBank Lazada Debit Card.

Image credit: unionbankph.com

Those who love online shopping can get the UnionBank Lazada Debit Card. It lets you earn 2 Lazada Credits for every P200 purchase in Lazada and 1 Lazada Credit for any other purchase of P200. On top of these, you can even get cashback rebates, discount vouchers, and access to exclusive sales.

All you need to do is apply through their app and request for a physical Mastercard debit card. No initial deposit or maintaining balance is required. You can even make deposits at 7-Eleven outlets or any of their 8,000 partner merchants in the Philippines.

Just note that this UnionBank debit card has a P500 annual fee but you can get this waived by maintaining an average daily balance (ADB) of P10,000.

UnionBank also has a great mobile banking app for people who value user experience.

Contact: website

For a list of branches, click here.

4. BDO – one of the banks with the most ATM machines across the country

BDO debit cards.

Image credit: bdo.com.ph

If you like paying with cash, you can open an account in a traditional bank such as BDO. It has one of the most branches and ATM machines for unlimited free withdrawals.

You’ll need to visit one of their branches to open an account. Choose between a Visa or Mastercard. Once you have your BDO debit card, you can set your online purchase and ATM withdrawal limits on your own online or through their app.

BDO also partners with different merchants such as Grabfood, SM Supermalls, Agoda.com, Emirates, and more, and even debit card holders can enjoy perks. You’ll be notified of these deals via email.

Just maintain a P2,000 balance on your BDO debit card to avoid fees.

Contact: website

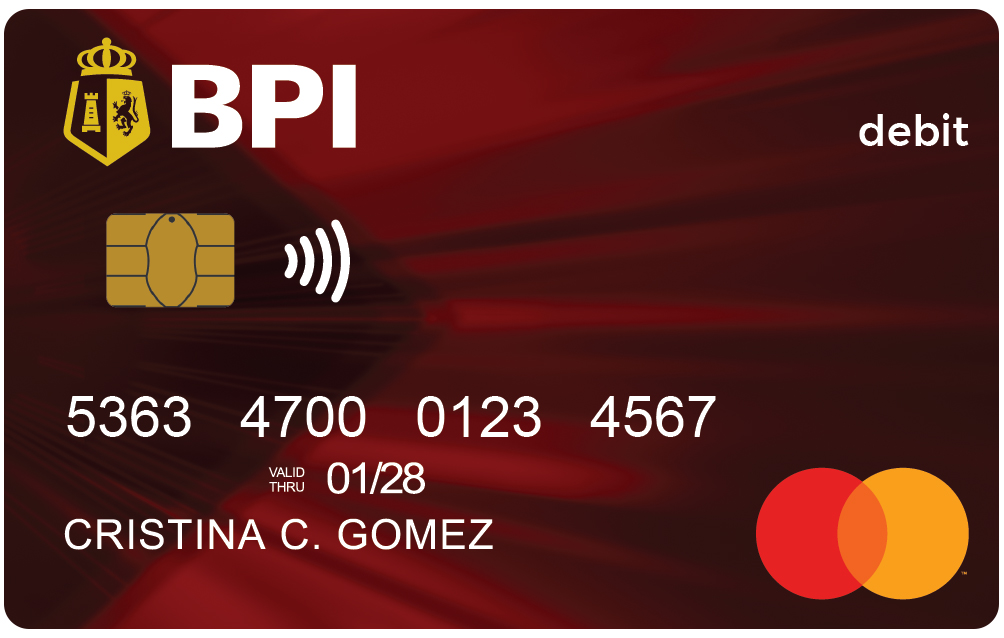

5. BPI Debit Mastercard – convenient mobile banking features

BPI Debit Mastercard.

Image credit: bpi.com.ph

BPI offers the best of both worlds, with many branches and ATM machines nationwide and a mobile app that has plenty of features which allow you to transfer your money and pay your dues conveniently.

The bank has 24/7 cash deposit machines so you don’t have to make time during office hours to secure your money. But if you can’t go to one of these, they offer free cash-ins through GCash, ShopeePay, and Maya.

They even go beyond bank-to-bank transfers. You can remit money from your BPI account to your family through LBC, Cebuana Lhuillier, MLhuillier, and the like.

BPI’s mobile banking app also has card control that lets you adjust withdrawal and purchase limits, and enable or disable international access. A maintaining balance of P3,000 is required.

Contact: website

For a list of branches, click here.

6. Komo – savings goal and budget tracker features

Komo debit card.

Image credit: Komo via Facebook

Komo is a digital bank owned by EastWest bank where you can get a free Visa debit card. It offers a 2.5% interest rate per annum and requires neither a minimum deposit nor a maintaining balance.

The savings goal and budget tracker features on the Komo app help you keep your spending in check. You can also pay your bills conveniently through the app to avoid extra fees.

You only need 1 valid ID to sign up for an account on their app. No minimum maintaining balance or deposit is required.

While Komo itself doesn’t have a physical branch, you get free withdrawals at EastWest ATMs and 4 free withdrawals per month at any BancNet ATM.

Contact: website

7. GoTyme – 3x points for purchases from Gokongwei businesses

GoTyme Bank debit card.

Image credit: @queen_rebel7 via Instagram

GoTyme Bank is the newest player in the Philippine digital bank field. It’s a partnership between Gokongwei Group and the multi-country digital bank, Tyme Bank.

It offers 3% interest rate per annum, 3 free bank transfers per week, and 3x Go Rewards points when you shop at Gokongwei-owned businesses such as Robinson’s Supermarket, Shopwise, and Daiso Philippines.

Sign up on their app to set up an account. No minimum balance is required and there are no caps on deposits.

Then, you can print a Visa debit card for free from a machine at select Robinson’s Supermarkets.

Contact: website

8. PSBank Kiddie and Teen Savings – savings account with a debit card for young savers

Image credit: psbank.com.ph

If you’re looking to open your child their first bank account and teach them financial responsibility, check out PSBank‘s Kiddie and Teen Savings.

You can request a debit card and a passbook but you can also track transactions online through their app. Parents can also opt for PSBank’s automatic intra-bank fund transfer service to regularly deposit money into their child’s account.

No initial deposit or maintaining balance is required and you earn 0.50% interest as you reach the P2,000 requirement. On top of these, your child gets free personal accident insurance from AXA Philippines which is equivalent to five times the account’s monthly ADB.

Kiddie Savings is for kids aged 0 to 12, while Teen Savings is for those aged 13 to 18.

Contact: website

For a list of branches, click here.

9. PNB-PAL Mabuhay Miles Debit Mastercard – earn miles and shopping points

Image credit: pnb.com.ph

You don’t need a high-end credit or debit cards to start earning miles. The PNB-PAL Mabuhay Miles Debit Mastercard lets you earn points for every purchase – not just Philippine Airlines flights – and them for domestic and international travel.

Besides flight tickets, you can use your miles for flight add-ons or convert them to SM Advantage Card points for shopping at SM malls. You can also enjoy a 500 Mabuhay Miles welcome gift if you make a PAL transaction within 3 months of card issuance.

This debit card requires a minimum deposit of P3,000 and a minimum maintaining balance of the same amount.

Contact: website

For a list of branches, click here.

1o. Tonik Debit Card – multiple savings options with high interest rates

Image credit: @card.hoard via Instagram

The digital bank Tonik‘s debit card is linked to a savings account that offers different high-interest savings options.

The stash feature allows you to work on your financial goals with a high 4% interest per annum. To boost your returns, you can open a time deposit hassle-free through their app.

If you and your family or friends are working on a common financial goal such as a trip, use the group stash which offers a slightly higher interest rate at 4.50%.

Even without using the stash features, Tonik provides a 1% higher interest per annum compared to traditional banks, with no minimum deposit or maintaining balance. The only caveat is that you have to pay a P300 fee to get a physical Tonik debit card.

Tonik also offers free online transfers to other banks via InstaPay and PESONet. Meanwhile, cash withdrawal is free at select ATMs.

Contact: website

Debit cards in the Philippines to start you off

Being smart with your money is an integral part of adulting. So if you have the privilege to have extra money from your paycheck each month, definitely consider getting one of these debit cards in the Philippines that are great for beginners. Goodluck reaching those financial goals this year!

Safeguard your money by staying informed about money scams in the Philippines. And since health is also wealth, take a look at these HMO and prepaid cards in the Philippines.

Cover image adapted from: gcash.com, unionbankph.com, bpi.com.ph, maya.ph

Originally published on 11 January 2023 by Kim Shelly Tan. Last updated on 11 January 2024 by Kim Shelly Tan.